401k inheritance tax calculator

Roll the funds into your own 401k if permitted and calculate RMDs. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

The exception is a Roth 401k which is funded with after-tax dollars so withdrawals are generally fully tax-free.

. When you enroll in a 401 k youll name beneficiaries to inherit your 401 k if you die. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Free estate tax calculator to estimate federal estate tax in the US.

First all contributions and earnings to your 401 k are tax deferred. While it may seem tempting to cash out your retirement plan money for emergencies or short-term expenses know that you could lose a significant portion of that. If youd like to save even more for retirement consider opening an individual retirement account which gives you another 6000 in tax-advantaged contributions or 7000.

Instead you have only two options. If the person you inherited the 401 k plan from was not yet age 72 or 70 12 if they turned 70 12 before January 1 2020 the 401 k plan will. If They Were Not Yet Age 72.

Dont Wait To Get Started. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. You as the 401k beneficiary will immediately get.

A 401 k can be one of your best tools for creating a secure retirement. But its not all bad news because you would have a number of. Naming beneficiaries can keep your 401 k out of probate court.

Typically distributions of inherited 401k assets are added to the beneficiarys taxable income for the year. Also gain in-depth knowledge on estate tax and check the latest estate tax rate. Calculate the required minimum distribution from an inherited IRA.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. It provides you with two important advantages. This is known as 401k tax planning.

Ad Learn More About American Funds Objective-Based Approach to Investing. Ad Learn More About American Funds Objective-Based Approach to Investing. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

An inherited 401k can help shore up your financial situation but there are rules and tax implications. Understand the different types of trusts and what that means for your investments. The amount paid is based on the ordinary income tax rate of the.

However distributions from a Roth 401k may be tax-free if the account was at. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Use this calculator to estimate how much in taxes you could owe if.

So as we have discussed beneficiaries are unfortunately required to pay tax on any 401k that they inherit. Disclaim the account or transfer the assets to an inherited IRA and take the RMDs. Upon the death of a 401k retirement saver all of his 401k savings and balances become taxable.

Ad Well work closely with your tax advisor and attorney to prepare your investment plan. TIAA Can Help You Create A Retirement Plan For Your Future. 4 You must disclaim the account within nine months of.

Ad Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

Inheritance 401 K A Guide To Inheriting A 401 K District Capital

Tax Calculator Tax Preparation Tax Brackets Income Tax

Capital Gain Tax In The State Of Utah What You Need To Know Capital Gains Tax Capital Gain Education Savings Account

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Inherited Iras A Sweet Deal Inherited Ira Ira Individual Retirement Account

What Happens When You Inherit An Ira Or 401 K

2022 Transfer Tax Update

Pin By Bree Johnson On Money Saving Tips Finance Lessons Budgeting Money Financial Peace University

The Best Tool For Tax Planning Physician On Fire

The Best Tool For Tax Planning Physician On Fire

401 K Inheritance Tax Rules Estate Planning

Year End Financial To Do List How To Plan To Do List Financial

A Guide To Inheriting A 401 K Smartasset

A Guide To Inheriting A 401 K Smartasset

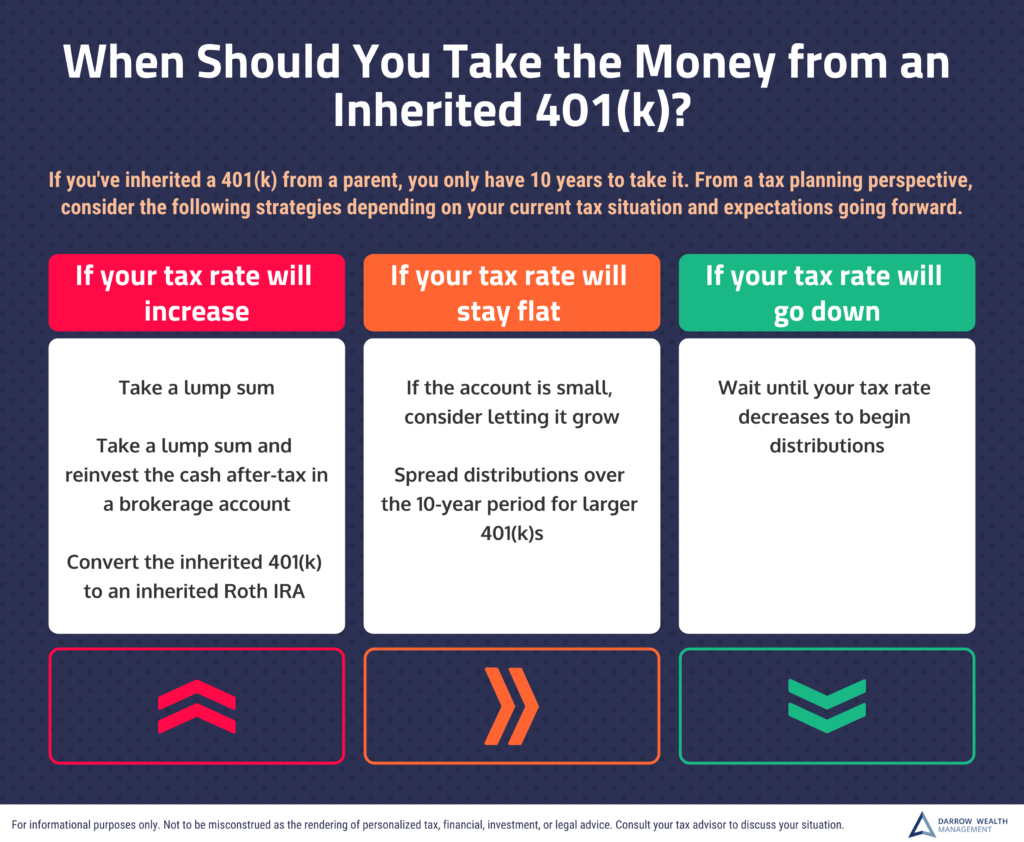

Inherited A 401 K From A Parent Tax Planning For Distributions

Inheritance Tax Here S Who Pays And In Which States Bankrate

:max_bytes(150000):strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work